March MLS® sales of 1,436 second highest on record for this month

WINNIPEG, April 8, 2022 — When comparing March sales of 1,436 to past years, the 5-year average shows an increase of 11%, making this the second-best March on record. However, last year was record-smashing when March sales soared to 1,975 for the first time in the Winnipeg Regional Real Estate Board’s history. Prior to that, 2020 and 2019 had each recorded just over 1,000 sales.

New MLS® listings of 1,848 entered in March 2022 was a decrease of 26% compared to last year. The result was that the available supply of listings at month end were down 27% in comparison to the same time last year, with 1,822 listings available for sale in April.

“Our recent 2022 Market Insights Annual Forecast Event made clear the Winnipeg Regional Real Estate Board market region will be hard pressed to repeat such stellar sales in 2022 that occurred in 2021,” said Akash Bedi, 2022 President of the Winnipeg Regional Real Estate Board. “This has been the pattern so far with high conversions of active listings to sales with fewer listings to realize peak sales levels attained last year.”

In examining March conversion of MLS® listings to sales at 78%, it aligns very well with the high percentage achieved in March 2021, with only one percentage point lower in 2022. Single-family active listing conversions are identical for both years at just under 82% while condominiums are almost the same at 73% in conversions. Prior to 2021, conversions were significantly lower for this time of year.

This pattern is replicated for the first quarter of market activity with respect to MLS® listing conversions to sales. In both 2022 and 2021, approximately 72% of listings entered on the MLS® for the first three months sold. In prior years, fewer than 50% were converted.

“Demand in 2022 remains very brisk, as we experienced in 2021” said Bedi. “The difference in 2022 is that we are seeing fewer sellers engaged in our market despite the opportunity they have to take advantage of strong seller’s market conditions.”

Another difference in 2021 is the increase in both variable and fixed mortgage rates, which may be a contributing factor with fixed-term mortgage holders deciding to hold onto the favorable terms they have in place with respect to financing their existing home. Some other MLS® property types, such as vacant land and duplexes, are seeing significant decreased sales from last year’s best start ever.

For the first three months of 2022, MLS® sales of 3,082 are down 26% from 2021 but up 6% over the 5-year average. Dollar volume of $1.15 billion for the first quarter dropped 14% from last year but has increased 25% over the 5-year average.

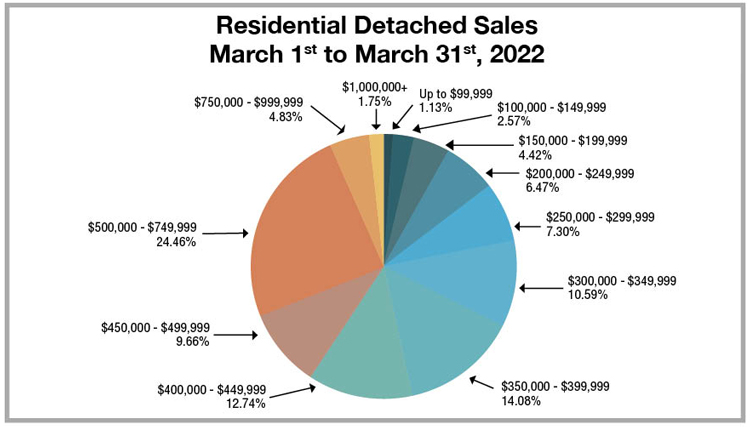

The lower fall-off in dollar volume compared to sales in 2022 is an indicator of prices rising noticeably from the end of 2021 in comparison to the same time last year. For single-family detached homes, the average sales price of $439,535 in March has increased 15.7% from the 2021 average sales price of $379,844, and 14.2% from the March 2021 average sales price of $384,773.

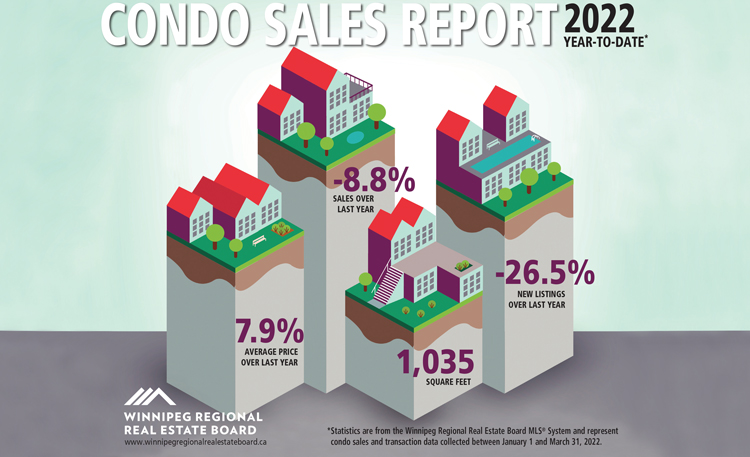

Condominium prices have gone up as well, but not to the same extent as single-family homes in the first quarter of this year. The March 2022 average condominium sales price is $260,731, a 5% increase over March 2021, and 6% higher than the 2021 average condominium sales price of $244,957.

“The flight to more affordable living options in our regional market exists with movement of first-time buyers in particular to condos over homes, given the latter’s much higher prices,” said Bedi. “First quarter 2022 shows condo sales performing better than single-family, with a 9% decrease in sales compared to the same period in 2021, whereas single-family home sales have fallen 27%.”

March is the first month this year when condominium sales were not able to match or exceed 2021 sales. They were down 21% but up 71% and 64% over the same month in 2020 and 2019 respectively.

The pronounced seller’s market conditions for single-family detached homes have led to a rapid rise in house prices in 2022 compared to 2021. While southwest Winnipeg was highlighted last year as the MLS® zone with the highest sale prices in the entire market region — and remains so — other zones need to be watched given their quick ascendancy in prices in the first quarter of 2022.

Southeast Winnipeg surpassed $500,000 in its average sales price for the first quarter. Helping make this progression possible is River Park South, one of its busiest MLS® areas, reaching over this threshold and the two MLS® areas encompassing Royalwood, Island Lakes, Bonavista and Sage Creek at the $690,000 price level.

The regional zone beyond Winnipeg city limits rose over $400,000, as did northeast Winnipeg. In the first quarter of 2021, they were both under $350,000. While it is still early in the year with 10 sales, the south Headingley MLS® area (south of Assiniboine River) had an average sales price of $1,126,075.

A standout for a higher average sales price in northeast Winnipeg is the east Transcona MLS® area with an average sales price of $467,321, which was $375,660 for the same period in 2021. While this active MLS® area has similar percentage conversions of listings to sales in the first quarter of this year as it did in the first quarter of 2021, there were 60 listings entered versus last year’s 92.

“Supply-constrained MLS® areas are pushing prices up at a rate not seen before,” said Bedi. “While our market region remains more affordable than most other markets in the country, it is not immune from the impact of demand/supply imbalances.”

Another indicator of rising prices in 2022 is the number of single-family homes and condominium listings that resulted in higher than list price sales. For the first quarter of this year, single-family was at 61% while condominiums had one in four sell for more than list price. In comparison to 2021, it was 47% for single-family and 13% for condominiums.

An indicator of higher single-family priced sales in March 2022 compared to the same month last year, despite 309 more sales in 2021, was that there were 17 million-dollar-plus sales compared to 7 last year, and 98 sales from $600,000 to $699,999 versus 66 in this price range last year.

“Spring is here and every expectation is for a strong start to the second quarter with a fresh influx of new listings to help it along,” said Bedi.

“In a fast-paced market with a lot at play, you need to be seeking the objective advice and counsel of a professional REALTOR®,” said Marina R. James, CEO of the Winnipeg Regional Real Estate Board. “For sellers, a REALTOR® can provide you with the appropriate feedback to maximize the return on your greatest asset.”

-30-

Winnipeg Regional Real Estate Board (WRREB) is a not-for profit corporation founded in 1903 by a small group of real estate practitioners. Today, as one of Canada's longest running real estate boards, WRREB serves over 2,300 licenced real estate Brokers and Salespersons, along with other industry related professions in and around the Winnipeg Metropolitan Region providing them with essential resources to enhance professionalism, advance the industry's development and enrich the communities they serve. WRREB is the collective voice for both its residential and commercial REALTOR® Members and operates under the direction of an elected voluntary Board of Directors.

The MLS® is a co-operative real estate selling system operated and promoted by the Winnipeg Regional Real Estate Board that includes an up to date inventory of listings from participating REALTORS®.

The trademarks MLS®, Multiple Listing Service® and the associated logos are owned by The Canadian Real Estate Association (CREA) and identify the quality of services provided by real estate professionals who are members of CREA. The trademarks REALTOR®, REALTORS® and the REALTOR® logo are controlled by CREA and identify real estate professionals who are members of CREA.

Media Inquiries:

Peter Squire

Vice President, External Relations & Market Intelligence

Winnipeg Regional Real Estate Board

psquire@wrreb.ca

Office: 204-786-8857